Financial Outsourcing

Once a newly established foreign-invested enterprise (FIE) or Representative Office is formally established, it is required to maintain proper accounting records in accordance with Chinese accounting standards and to report taxes on both a monthly (business tax and individual income tax) and quarterly (corporate income tax) basis. Please note that late submissions will result in penalties and surcharges. It is the responsibility of FIEs to register their tax reporting method with their local tax authority. Furthermore, they are required to obtain an official invoice book, which will enable them to issue invoices to their clients in China and abroad.

A WFOE (a major type of FIE) is required to maintain a complete accounting system and prepare financial statements. It is essential to set up three main accounting books: journals, a general ledger and subsidiary ledgers, along with the necessary supporting documents. Computerized accounting records are also permitted. All supporting documentation, accounting records and financial statements must be prepared. The Renminbi (RMB) is the designated currency for all bookkeeping activities. In the event that a foreign currency is utilized, the financial statements must be converted into RMB at the conclusion of the fiscal year. In China, the accounting year is the calendar year, commencing on 1 January and concluding on 31 December. The accounting system is based on the accrual basis.

We understand that it takes time for a newly established corporation to get its regular staff in place. It is of the utmost importance for a corporation to maintain a stable and integrated financial system. However, unstable personnel can pose a challenge to this stability. Financial outsourcing can be an excellent solution. The cost of financial outsourcing services is only 20% to 30% of the cost of employing a full-time accountant. Clients can rest assured that they will not have worry about personnel changes or financial data security. Furthermore, our accountant will assist clients in negotiating with the local tax office on the most appropriate tax reporting method and in submitting the quarterly and monthly tax reports on the client's behalf. Furthermore, our experienced accountant will assist clients in establishing a formal financial system, which will greatly reduce legal risk. Our accountant is typically able to provide clients with valuable guidance on how to legally avoid taxes and stay informed about policy changes.

Financial Outsourcing Service

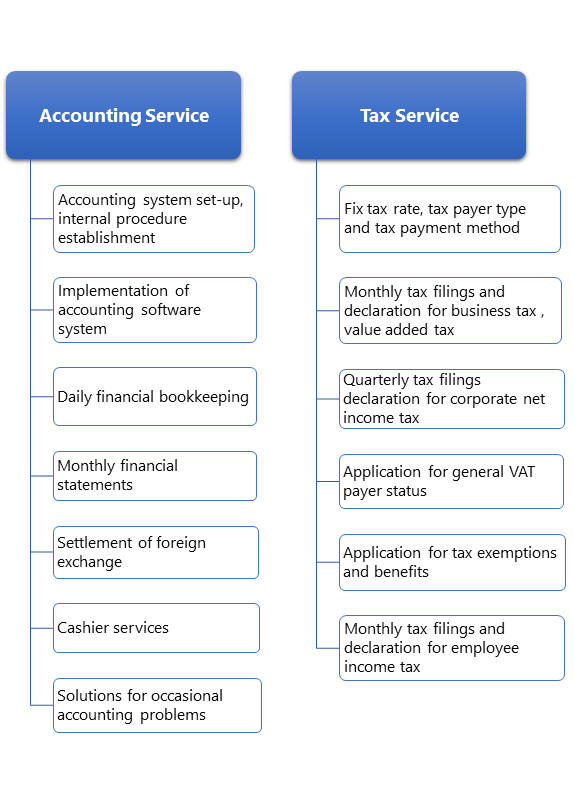

Our financial outsourcing service includes two parts which are accounting service and tax service.

Accounting Service

Due to rapidly evolving accounting system in China, it is a tough work for many foreign invested enterprises to keep pace with new policies and accounting standards which may come out without enough public notice. Our professional team is equipped with a thorough understanding of tax laws and an extensive practical experience, which enable us to assist our clients from the initial stage.

Tax Service

With frequently changing of tax regulations which are all in Chinese, tax compliance in China is usually a challenge for foreign invested enterprises. Having a reliable tax agent like RCS can save clients time and money, to release clients from endless contacting and negotiating with different tax departments.

By our close relationship with local tax authorities, we offer high quality tax service to bring clients with great potential value and direct economy value.