WFOE Registration

We have assisted hundreds of overseas investors in establishing their WFOEs and other types of entities in China, offering a comprehensive, one-stop service for those seeking to invest in China. We appreciate that many overseas investors are keen to establish their new business in an efficient and straightforward manner, particularly those in the SME (small and medium-sized enterprise) sector. We assist with the registration of representative offices, Wholly Foreign-Owned Enterprises (WFOEs), Sino-foreign joint ventures (JVs), and other types of entities. Our senior consultants are well-versed in local policies and are adept at devising bespoke service plans for diverse clientele. Our close ties with government departments streamline processes for our clients and facilitate seamless operations. Furthermore, we offer comprehensive services for annual inspections, address changes, and representative changes for WFOEs, JVs, and Rep offices.

Foreign investors typically gravitate towards WFOEs, rep offices, and joint ventures. Our detailed overview aims to assist you in making an informed decision.

Wholly Foreign Owned Enterprise (WFOE)

China government is now encouraging foreign investors to set up WFOE which is the main type of entities for foreign investors. Especially in Ningbo, even 100,000RMB registered capital will be an acceptable amount of capital for an International Trading WFOE. WFOE doesn't have to transfer the registered capital to China before the registration starts. All registered capital is allowed to be in place within 5 to 30 years after the registration. If a WFOE can be approved as a Hi-Tech company by local government it can even enjoy some special preferential policies such as tax deduction or office rental allowance. WFOE can also apply for license of export and import after the registration.

The structure of a WFOE usually requires it to keep more regular staff comparing a Rep office. Although WFOE registration documents are much more than a Rep office, we can help clients prepare most of the registration documents which will save great energy for the clients.

Sino- Foreign Equity Joint Ventures (JV)

JV mainly fits to the investor who already has reliable Chinese partner. It will usually reduce great business risk to cooperate with a mature Chinese partner. Foreign investor will operate and share the risk in proportion to the amount of registered capital inputted by the respective parties. Each party is accordingly jointly responsible for the profits and losses of the enterprise and the proportion of investment offered by the foreign investor should be no less than 25%. Also, due to government control, for some business activities such as railway transportation, value added service of telecommunication, banking, insurance and marketing, foreign investors still must set up JV to start this business.

The feature of JV requires foreign investors to choose their Chinese partner very carefully. It is easier for the Chinese shareholder to control the JV because it is more familiar with local market and policies even some convention.

China Representative Office

China representative office is a branch in China who represents the overseas company. Representative office is not a separate legal entity. It cannot do business directly which means it cannot sign any purchasing contract with Chinese supplier or make invoice. But with many natural advantages, representative office is the first choice for many foreign enterprises. Short registration period and no registered capital required make it possible for foreign enterprises to start their business in China in a quick and inexpensive way. Representative office can also employ Chinese staff through local HR outsourcing company like RCS.

Recently, China government has raised the standard and complexity of required documents for Rep office registration. Also, the tax rate for Rep office has been gradually increased these years.

▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁

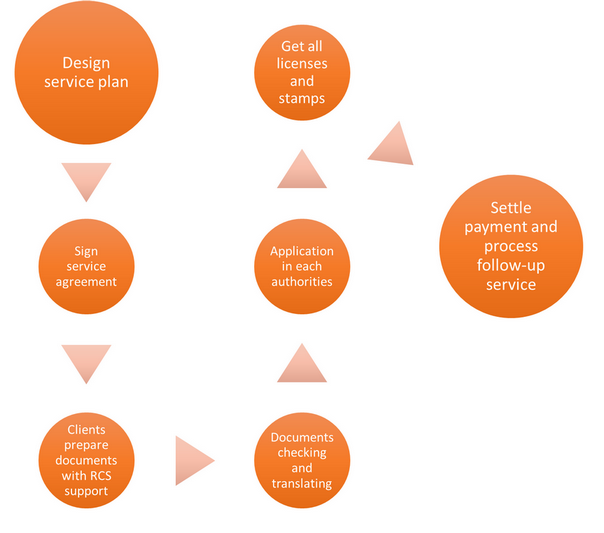

Process of Establishing WFOE (JV) & Rep. Office

▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁▁

Brief procedures Of Setting up a Trading WFOE through RCS

01 Check and Register Company Name

02 Apply for Letter of Approval and Certificate of Approval

03 Apply for Business License [Company be officially established]

04 Make company stamps (three stamps)

05 Apply for Organization Code License

06 Register in Tax Bureau (National tax and Local tax)

07 Register Foreign Currency bank account opening approval

08 Open a Foreign Currency and RMB bank account

09 Remits capital from Overseas account and verify the arrived capital in bank

10 First time tax report

11 Obtain the import/export licenses

12* Free Valued Services: 1 year working visa, 1 month’s accounting service

Documents and Information Required from Investor to Start the Registration

1、Investor's passport copy (investor is foreign natural person) or company business license copy (investor is foreign company) should be certified by the local notary public in Investor's native country first and then certified by the Chinese embassy or consulate there.

2、Investor's bank deposit certification is required. Sample will be provided on client's request.

3、Client shall provide two to three expected Chinese name of the WFOE.

4、Office lease contract and house ownership certificate copy are required(lessee should be the Chinese name of the WFOE).

5、WFOE must set two positions during the registration which are legal representative and supervisor.

6、WFOE's legal representative's ID copy (Chinese) or passport copy (Foreigner) and his or her CV are required

7、Legal representative should provide two 2-inch photos.

8、Supervisor's ID copy (Chinese) or passport copy (foreigner) is required.

9、 Authorization letter of authorizing us to handle the registration process and sign on related documents is required. Authorization letter should be signed by the investor and please provide two original copies.

About Registered Capital

10、How to determine your WOFE's registered capital: Registered capital is the start-up capital for a newly opened company-company runs with this capital until it can gain profit. From 2014 March China government has cancelled the concept of " minimum registered capital" which is a guideline before. We suggest our client decide the amount of registered capital according its own business type and company size. If the intended registered capital seems inadequate local authorities will review all the registration documents and make the approval on a case-by-case basis.

About Business Scope

11、To start the registration company business scope shall be determined and it helps to define WOFE's main business type and products or service engaged.

About TAX

12、The main tax for a purely international trading WFOE is corporate net income (net profit) tax which is 25% of WFOE's quarterly net profit. It is practically acceptable to tax authority that a newly registered WFOE has not net profit in the first one or two years while years of continuously deficit may cause interpellation from tax authority.

About Company Chinese name and English Name

12、There will only be Chinese in all registration licenses and certificates. English name will be required during import and export rights application and bank account opening. English name must be in accordance with the Chinese name. It must be translated according to the meaning or pronunciation.

Other Information

13、We will help to make all of the registration documents except documents which have to be provided by the investor directly such as embassy certification and bank letter.

14、The whole company registration process will take one and half months to 2 months after we receive necessary documents and information from investors.

15、Export and import license application can be started after registered capital arrives.

Follow-Up Work

16、After the registration process is completed, it's very necessary for the investor to be informed of and prepare for the following issues:

i. Newly registered company will have to go to the tax bureau to fix tax declaration details within one month after the tax registration.

ii. Before fixing the tax details, company shall open its primary bank account and account for receiving registered capital. (The original passport of the WFOE's legal representative shall be presented during the opening of company's bank account).

iii. Company will have to establish formal financial system and report its financial status to the tax bureau regularly and pay tax accordingly.

iv. Company must keep a professional accountant to handle the above mention matters. Accountant can be a full-time one or part-time one.

We will appoint an experienced accountant who helps client to handle the above-mentioned duties which is our financial outsourcing service.

Newly registered company will have to do the certification of registered capital as soon as possible after investor transfer the first-time investment capital to WFOE's capital account (before that, WFOE will have no fund to support its daily operation cost.) We will help to arrange the process of certification of registered capital as soon as client's bank account is ready.